So much more than an expensive, traditional financial plan managed by others. Traditional plans just scratch the surface and can become outdated and irrelevant over time.

Whether you are 40 or 80, plan for your primetime, making sure all planning bases are covered and up to date.

Self manage, get experts to help, or a combination of both. Its up to you.

A plan you control without compromise.

Use our checklists, planners, calculators and other key planning tools free of charge

Video tutorials provide clear instructions

Specific planning components cover each key planning aspect

Start planning now for free with the Evaluation available at zero cost

Accommodation

Am I going to need to move in the future?

What would be most suitable going forward?

Accommodation choices can have a significant impact on both finances and lifestyle for retirees and getting it right means using the head and the heart.

Read more

Estate Planning

If something happened to me or I passed away, would my partner and family be taken care of as I have intended?

This can only be assured if estate planning is done properly and not out of date.

Read more

Evaluation

How do I start planning for retired life?

What are the priorities?

An evaluation is a systematic review of facts and feelings covering all planning aspects in order to clarify what to plan for and when.

Read more

Care & Support

How would I go about getting care or support if needed ?

Most people find this complex, bureaucratic and constantly changing. If not planned ahead of time, choices can be limited and decisions might be made by others.

Read more

Roles & Responsibilities

What would happen if I could no longer manage all the tasks and roles that I do and which people rely on me for?

This is more than having a power of attorney, this is about having a backup plan, just in case.

Read more

Physical & Mental Health

Are health issues going to affect my Primetime plans?

Although we cant control the genetic lottery, it is widely accepted that health strategies can be commenced at any age which can prevent, or delay, symptoms of chronic illness.

Read more

Tax Planning

How can I ensure that I don’t pay too much tax in retirement and on my estate?

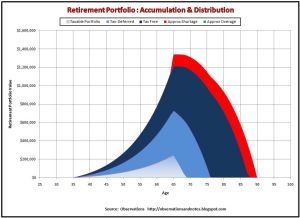

Tax and levies can be anywhere between nil to around fifty percent of gains. Well planned, pro active tax strategies are key to wealth maximisation and intergenerational wealth transfer.

Read more

Welfare & Benefits

Am I getting all of my entitlements?

Benefits and entitlements can have a big financial impact through retirement. Rules are constantly changing and keeping on top of this is certainly challenging.

Read more

ADVISORS CAN USE THE PRIMETIME PLANNING SYSTEM TO PROVIDE A BETTER PLANNING SERVICE AND BE COVID COMPLIANT

TESTIMONIALS

A service like this has been a long time coming. The Primetime personal service is essentially a ‘one stop shop’ that provides comprehensive advice on everything that can impact on living well after retirement. Their advice is not merely generic, but rather specific to your own situation. Every detail is considered, including your ‘bucket list’, your health and well being considerations, your finances and tax implications, and the very important estate planning. As full-time carer of my husband with dementia, I have been overwhelmed with the confusion of information ‘out there’ from various service agencies, government departments and organisations. Quite frankly, it is a minefield for the unwary – particularly for those who have little expertise in financial matters or dealing with Centrelink. Peter and Geoff were diligent in reviewing what plans I had in place, uncovered some issues that would have been very expensive mistakes on my part, and provided me with a detailed, comprehensive report covering different scenarios, plus an action plan that will ensure I will have everything in place for a worry-free future. I highly recommend Primetime to those with aging parents and anyone heading into retirement. Peace of mind is priceless.